Audit, Review & Compilation: How CPA reports differ

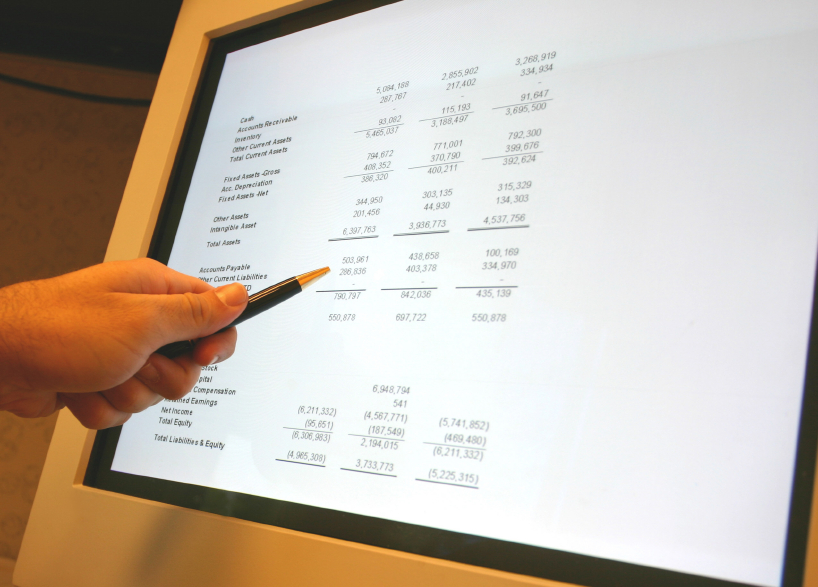

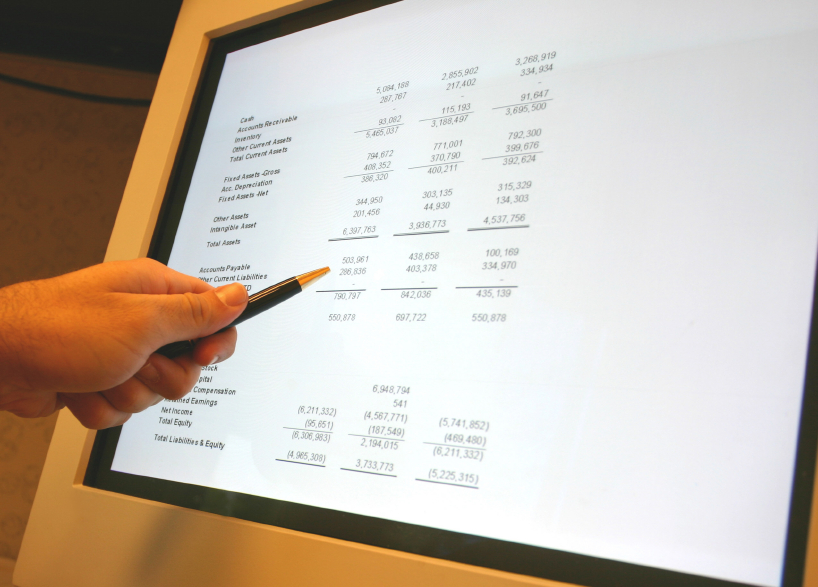

Many companies provide their financial statements, along with a CPA’s report, to lenders, investors, suppliers and customers. Informed readers of the report will gain varied levels of comfort based on the type of financial statement provided.

Not all reports are the same. A CPA can provide different levels of service related to a company’s financial statements.

The three general levels of financial statement service are audit, review and compilation. When do you need an audit? Businesses should work with their external auditors to determine what their real needs are so they can decide the right level of service. Is the need for the financial statement a debt covenant requirement? Shareholder use? Regulatory requirement? Performance measurement? Or perhaps compensation calculation?

With a clear understanding of what is needed, the correct decision can be made appropriately without wasting resources.

What is an audit?

An audit is the highest level of financial statement service a CPA can provide. The purpose of having an audit is to provide financial statement users with an opinion by the auditoron whether the financial statements are prepared in accordance with the proper financial reporting framework. An audit enhances the degree of confidence that intended users, such as lenders or investors, can place in the financial statements.

The auditor obtains reasonable assurance about whether the financial statements as a whole are free from material misstatement, and whether the misstatements are from error or fraud.

To obtain reasonable assurance, items are observed, tested, confirmed, compared or traced based on the auditor’s judgment of their materiality and risk. After gathering appropriate evidence through this process, the auditor issues an opinion about whether the financial statements are free from material misstatement.

As an additional benefit, the auditor may become aware of some deficiencies in internal control or weaknesses in the organization’s systems and offer suggestions for improvement. Some of the more important auditing procedures include:

✎ Inquiring of management and others to gain an understanding of the organization itself, including operations, financial reporting and known fraud or error

✎ Evaluating and understanding the internal control system

✎ Performing analytical procedures as expected or unexpected variances in account balances or classes of transactions appear

✎ Testing documentation supporting account balances or classes of transactions

✎ Observing the physical inventory count

✎ Confirming accounts receivable and other accounts with a third party

Ideally, auditors will provide an unqualified, or “clean,” opinion on the company’s financial statements. An unqualified opinion will contain language such as “the financial statements present fairly in all material respects” and “in conformity with accounting principles generally accepted (GAAP) in the United States.

If an auditor is unable to render an unqualified opinion, a qualified opinion may be issued. Some reasons opinions may be qualified include scope limitations and departures from GAAP.

A qualified opinion due to a scope limitation alerts the reader that, except for the matter to which the qualification relates, the financial statements present fairly, in all material respects, the company’s financial position. If the scope limitation is severe enough, the auditors may disclaim an opinion on the overall financial statements.

When an auditor issues a qualified opinion, the auditor believes the financial statements are fairly stated in all material respects except for a material departure from GAAP. But the auditor has concluded not to express an adverse opinion.

However, if the auditor concludes that the departures from GAAP are so significant that the financial statements as a whole are not fairly stated, an adverse opinion must be issued. An adverse opinion will include language describing what the auditor believes is materially misstated in the financial statements, and the effects of the misstatements. If the effects are not reasonably determinable, the auditors will state that.

What is a review?

A review engagement is conducted to provide limited assurance that there are no material modifications that should be made to the financial statements for them to be in conformity with the financial reporting framework.

A review differs significantly from an audit. Review engagements provide less assurance to the reader of the financial statements because the CPA does not perform many audit procedures. The broad review procedures required to be performed by the CPA are:

✎ Inquiries as to the accounting practices and principles used by the business

✎ Procedures for recording and accumulating financial information

✎ Actions taken at owners’ or directors’ meetings

✎ Written representations from management regarding the accuracy of all information given to the CPA

✎ Receipt of all relevant information by the CPA

✎ Management’s responsibility for internal control

✎ Management’s responsibility to prevent and detect fraud

✎ Knowledge of fraud

✎ Information related to any significant subsequent events

✎ Analytical procedures regarding comparisons

✎ Expectations developed by the CPA of recorded amounts

✎ Ratios from recorded amounts

✎ Plausible relationships of recorded amounts

These analytical procedures provide better understanding of key relationships among certain numbers. This understanding gives more assurance about the reasonableness of the financial condition presented in the financial statements.

Based on the inquiries and analytical procedures, the CPA is able to express only limited assurance that there are no material modifications that should be made to the financial statements for them to be in conformity with the applicable financial reporting framework. Because a review engagement is substantially less intensive in scope than an audit, the CPA cannot express an opinion on the fairness of the financial statements taken as a whole.

What is a compilation?

In a compilation engagement, the objective is to assist management in presenting financial information in the form of financial statements without undertaking to provide any assurance that there are no material modifications that should be made to the financial statements so they will conform to the acceptable financial reporting framework. Because of the even more limited scope of compilation procedures, the CPA’s report will not express an opinion or provide any assurance regarding the financial statements.

A compilation involves (1) gaining a general understanding of your business, accounting principles used and financial reporting system and (2) presenting financial information in the accepted format of proper financial statements. The CPA expresses no assurance about the accuracy of the financial statements presented. The report attached to the financial statement emphasizes that the service is a compilation.

While independence is required at the other levels of service, the CPA does not have to be independent of your organization to perform a compilation. The report must state that the accountant is not independent.

Further options lie within the compilation level of service. The compilation report may be a full disclosure report with complete footnote explanations of certain amounts and policies contained in the financial statements. Or, these otherwise required disclosures may be omitted. Omission of this information is not permissible under the other levels of service.

It is important to find the proper balance between the cost of the CPA’s services and the level of assurance the users of the financial statements require.

This article was originally posted on December 16, 2011 and the information may no longer be current. For questions, please contact GRF CPAs & Advisors at marketing@grfcpa.com.

What an Auditor Does and Doesn’t Do